Here is a small, simple but effective guide to how much tax you will have to pay and when exactly. Some explanations will also be given

How much tax should I pay?

You pay tax when your income is above the agreed amount per year and you pay all of your working life up to the age of 65. This tax is determined by SARS.

When do I pay

Tax work in tax years. The year starts at 1 March and end on 28 February but in a leap year, it will end on 29 February. You will have to submit a return in Tax Season.

Will other income be taxed?

Yes. All of us pay tax on other income we may have. Here is a small list of examples:

- Income from business activities.

- Rental Income.

- Investment income.

What must I do?

You have to register as a taxpayer with SARS. This will require you to complete a registration form. Once you have completed the form, you need to visit your local SARS branch and they will complete the registration.

What does my employer do?

Your employer withholds Employees tax from your salary and pay it to SARS monthly. There are certain amount which can be deducted from your salary before Employee Tax is worked out such as your pension, medical aid and some insurance premiums.

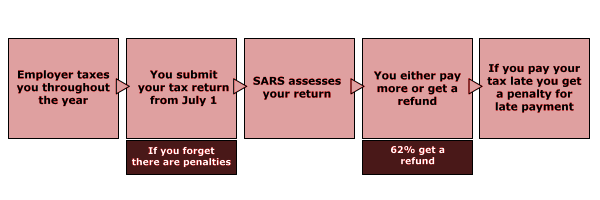

How does the process work?

Here is a small chart which will show you how the tax process works: